David Savastano11.05.15

While RFID is indeed enjoying sizable growth, manufacturers across the supply chain – chips, tags and readers – have had to develop technologies to overcome some of the initial concerns over the technology.

Improved sensitivity of the tags and readers has helped RFID overcome initial challenges, although it has led to some unexpected consequences.

“The technical challenges early on have been getting the right read distance as well as creating standards,” says Neil Mitchell, director of marketing for Alien Technology. “Chip, tag and reader sensitivity is much greater today. The new chips are so sensitive that readers are picking up one too many aisles now in stores. We have had to tune down the readers some. Another market challenge has been the market trolls, which slowed things down.”

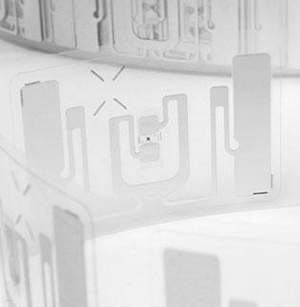

Avery Dennison RFID tags

“Nearly every new or disruptive technology goes through an up and down adoption cycle, and passive RFID was no different,” notes Michael Fein, RFID senior product manager, Zebra Technologies. “From maturity of standards to interoperability between vendors to pure speed and range of tags, RFID vendors have made enormous strides during the last decade.”

Francisco Melo, VP, global RFID, Avery Dennison, says that the challenge within apparel retail, for example, is similar to most major projects - success requires process change. Melo added that Avery Dennison’s RFID end-to-end solutions help to address some of the major challenges, increasing speed, accuracy, visibility, productivity and margins from source to consumer, and its five-step RFID adoption process, from Business Case to Full Adoption, helps retailers navigate the adoption process building on the learnings from the world’s largest and most successful RFID deployments.

“We’ve worked with leading retailers and brands around the world, including Macy’s, Marks & Spencer, and adidas to deploy a successful RFID program in the apparel sector,” comments Melo. “Through each of these programs, we’ve provided a range of efficiencies for retailers, including: increased sales as a result of reduced out of stocks; improved margins based on lower level markdowns; and reduced losses due to improved visibility. Our RFID technology has also enabled retailers to extend inventory accuracy in apparel to support omni-channel fulfillment, such as ship from store and in store pickup, in addition to allowing an immersive consumer experience, such as ‘smart dressing rooms.’”

“The rolling out and adoption of the PakSense AutoSense systems are making great strides in the effective automation of our customers’ supply chains,” says PakSense CTO Kaz Lawler. “The presence of the AutoSense readers allows PakSense to further release more and different types of environmental sensors to further facilitate our customers’ building of their supply chain.”

Now, the challenge is to show potential users what RFID can do for them.

“One of the greatest challenges facing RFID is the price point of the tag itself,” said Lawler. “Improvements in chip manufacturing have reduced part costs, while recent technology breakthroughs, like that of Thin Film Electronics, open up a wide range of applications for NFC-based RFID. The adoption of NFC in phones has increased the number of available readers and expanded the number of potential applications. This increase in readers and applications should lead to a decrease in the cost of tag and reader chip set for NFC products.”

“Today, the biggest challenge for passive RFID adoption isn’t technology but business process change to take advantage of what RFID can deliver,” Fein added. “As an example, many retailers only do a full physical inventory once a year because it takes an enormous effort to manually count items. With RFID, that same inventory process can be completed in hours or even minutes. The challenge for retailers is how to adapt their merchandising, re-stocking, and even pricing procedures to take advantage of the new visibility that RFID provides - that’s just one example of what Zebra calls Enterprise Asset Intelligence.”

“For UHF, which is seeing the most growth by tag volume at the moment, it has been to identify a strong use case, involving minimal infrastructure to keep costs low and a high value of the system to fix a problem (stock outs of clothing at the shelf level),” said Raghu Das, CEO of IDTechEx, a leading research firm. “Many different applications in retail were tried before this was identified.”

Outlook for RFID

With its current growth rate, it is clear that RFID will continue to grow in the coming years.

Das stresses the outlook for RFID is “very positive. We see the RFID market being worth $13.2 billion in 2020.”

“We expect continued growth,” Fein adds. “Passive RFID is a critical enabler of IoT applications, especially item-level tracking applications in retail, healthcare and manufacturing.”

“Currently, RFID drives inventory accuracy and visibility, which allows retailers to better optimize their supply chain and enable omni-channel strategies,” Melo says. “In the future, customers will explore new possibilities on how to get more out of the RFID enabled products, thus creating the need for smarter electronics, sensing and other key functions that could further improve the customer experience. Beyond retail, RFID will also play an important role in supply chain optimization around perishable foods and healthcare applications.”

“RFID applications will continue to increase dramatically as we pass through this present tipping point of cost, functionality, availability and consumer expectations,” Lawler notes. “RFID component prices will continue to drop and applications will become even more prevalent. We are already witnessing the growth of RFID use in luxury items not only for authentication, but also for improved product interaction and customer experience. Eventually RFID technologies will be used for the track, trace and validation of general products within the various supply chains.”

Mitchell emphasizes that RFID is definitely on the upswing. “For the past six quarters, thing are picking up,” he says. “The ROI is proven now. The cost of tags has come down to the 5 cents to 10 cents area. On the reader side, we just shipped our highest volume order to a company for mobile asset tracking for their vans. The opportunities for RFID are tremendous. The industry is still in the early days, even in the retail space, with only 1% penetration. The potential is just phenomenal, and Alien Technology is very well positioned.”

David Savastano is editor of Printed Electronics Now, a sister publication of L&NW.

Improved sensitivity of the tags and readers has helped RFID overcome initial challenges, although it has led to some unexpected consequences.

“The technical challenges early on have been getting the right read distance as well as creating standards,” says Neil Mitchell, director of marketing for Alien Technology. “Chip, tag and reader sensitivity is much greater today. The new chips are so sensitive that readers are picking up one too many aisles now in stores. We have had to tune down the readers some. Another market challenge has been the market trolls, which slowed things down.”

Avery Dennison RFID tags

Francisco Melo, VP, global RFID, Avery Dennison, says that the challenge within apparel retail, for example, is similar to most major projects - success requires process change. Melo added that Avery Dennison’s RFID end-to-end solutions help to address some of the major challenges, increasing speed, accuracy, visibility, productivity and margins from source to consumer, and its five-step RFID adoption process, from Business Case to Full Adoption, helps retailers navigate the adoption process building on the learnings from the world’s largest and most successful RFID deployments.

“We’ve worked with leading retailers and brands around the world, including Macy’s, Marks & Spencer, and adidas to deploy a successful RFID program in the apparel sector,” comments Melo. “Through each of these programs, we’ve provided a range of efficiencies for retailers, including: increased sales as a result of reduced out of stocks; improved margins based on lower level markdowns; and reduced losses due to improved visibility. Our RFID technology has also enabled retailers to extend inventory accuracy in apparel to support omni-channel fulfillment, such as ship from store and in store pickup, in addition to allowing an immersive consumer experience, such as ‘smart dressing rooms.’”

“The rolling out and adoption of the PakSense AutoSense systems are making great strides in the effective automation of our customers’ supply chains,” says PakSense CTO Kaz Lawler. “The presence of the AutoSense readers allows PakSense to further release more and different types of environmental sensors to further facilitate our customers’ building of their supply chain.”

Now, the challenge is to show potential users what RFID can do for them.

“One of the greatest challenges facing RFID is the price point of the tag itself,” said Lawler. “Improvements in chip manufacturing have reduced part costs, while recent technology breakthroughs, like that of Thin Film Electronics, open up a wide range of applications for NFC-based RFID. The adoption of NFC in phones has increased the number of available readers and expanded the number of potential applications. This increase in readers and applications should lead to a decrease in the cost of tag and reader chip set for NFC products.”

“Today, the biggest challenge for passive RFID adoption isn’t technology but business process change to take advantage of what RFID can deliver,” Fein added. “As an example, many retailers only do a full physical inventory once a year because it takes an enormous effort to manually count items. With RFID, that same inventory process can be completed in hours or even minutes. The challenge for retailers is how to adapt their merchandising, re-stocking, and even pricing procedures to take advantage of the new visibility that RFID provides - that’s just one example of what Zebra calls Enterprise Asset Intelligence.”

“For UHF, which is seeing the most growth by tag volume at the moment, it has been to identify a strong use case, involving minimal infrastructure to keep costs low and a high value of the system to fix a problem (stock outs of clothing at the shelf level),” said Raghu Das, CEO of IDTechEx, a leading research firm. “Many different applications in retail were tried before this was identified.”

Outlook for RFID

With its current growth rate, it is clear that RFID will continue to grow in the coming years.

Das stresses the outlook for RFID is “very positive. We see the RFID market being worth $13.2 billion in 2020.”

“We expect continued growth,” Fein adds. “Passive RFID is a critical enabler of IoT applications, especially item-level tracking applications in retail, healthcare and manufacturing.”

“Currently, RFID drives inventory accuracy and visibility, which allows retailers to better optimize their supply chain and enable omni-channel strategies,” Melo says. “In the future, customers will explore new possibilities on how to get more out of the RFID enabled products, thus creating the need for smarter electronics, sensing and other key functions that could further improve the customer experience. Beyond retail, RFID will also play an important role in supply chain optimization around perishable foods and healthcare applications.”

“RFID applications will continue to increase dramatically as we pass through this present tipping point of cost, functionality, availability and consumer expectations,” Lawler notes. “RFID component prices will continue to drop and applications will become even more prevalent. We are already witnessing the growth of RFID use in luxury items not only for authentication, but also for improved product interaction and customer experience. Eventually RFID technologies will be used for the track, trace and validation of general products within the various supply chains.”

Mitchell emphasizes that RFID is definitely on the upswing. “For the past six quarters, thing are picking up,” he says. “The ROI is proven now. The cost of tags has come down to the 5 cents to 10 cents area. On the reader side, we just shipped our highest volume order to a company for mobile asset tracking for their vans. The opportunities for RFID are tremendous. The industry is still in the early days, even in the retail space, with only 1% penetration. The potential is just phenomenal, and Alien Technology is very well positioned.”

David Savastano is editor of Printed Electronics Now, a sister publication of L&NW.