Greg Hrinya, Associate Editor08.21.19

From Harlequin to Adobe, Xitron has engineered a host of prepress solutions for workflow development. The Navigator RIP, which has been under consistent development since its inception in 1992, features 64-bit architecture, native PDF interpretation, accurate transparency rendering, and customizable workflow modules.

The new Navigator Flexo Suite isn’t just a RIP and plate ganger, though. It includes SmartFlexo screening, which hits the market at an economical price point.

The Navigator Flexo Suite has seen its biggest improvements in the screening algorithms. “Instead of just offering two or three combinations of resolution, structural dot size, and AM to FM change point, the SmartFlexo screening interface lets each user make adjustments based on their ability to hold dots on plate and print dots on press,” says Bret Farrah, executive vice president of Xitron. “It’s a very customizable approach that helps printers attain maximum quality instead of solutions that work ‘most of the time.”

The Navigator Flexo Suite comes with a low on-board price designed to mesh well with the low cost flexo CTP systems that are now available. Farrah notes, too, that the product will also replace aging and expensive workflows driving existing CDIs.

Traditionally, the investment cost for flexo CTP registered in the neighborhood of $120,000-150,000, for starters. Most new CTP’s come in at the $40,000 range, and Xitron offers its suite for less than $15,000.

“The price/performance ratio has skyrocketed as newer engines have hit the market at very reasonable prices,” notes Farrah. “This means that printers who couldn’t afford in-house platemaking before can now leverage the technology with an attractive ROI.”

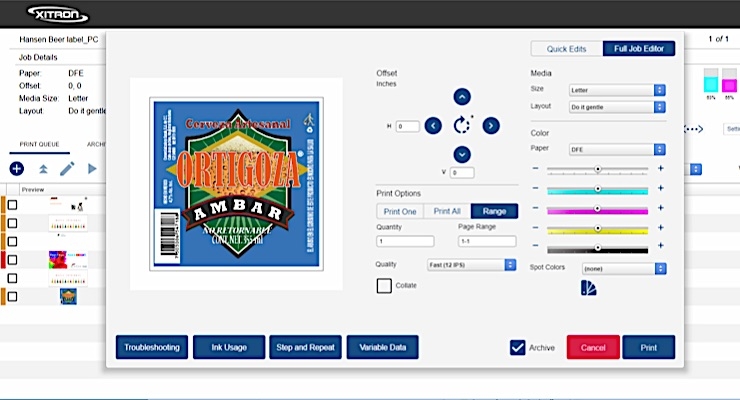

Farrah describes the enhanced Navigator Flexo Suite as “unstructured and uncomplicated.” “You can see it when you look at the interface,” he says. “The user can select any resolution, so virtually all CTP engines are covered–even the newer 9600 dpi HD machines. Similarly, there are no restrictions on LPI or where AM changes to FM in highlights and shadows. Just as important, I think, is the flexibility with regard to surface screening (called SmartCells) for better coverage with solids. There are multiple attributes the customer can control, including AM or FM patterns, special shapes, and dot edge protection that are all user-definable and will remove pixels from solid areas for better ink distribution. This is really the first application that puts the user in complete control instead of confining them to a rigid structure and forcing them to conform.”

Just as Xitron partnered with OEM’s, such as Mark Andy, Agfa, and Xeikon, throughout the years, the company has turned its attention to high-speed inkjet and Digital Front End (DFE) workflows. The company is now working with companies like Memjet, Colordyne, Trojan, and multiple others.

“Without question, these partnerships have given us a quick shot out of the starting blocks,” explains Farrah. “When we started development with Memjet several years ago, we were able to learn, grow and develop in parallel with their printhead advancements. We then applied that knowledge to branch development in conjunction with Meteor and Global Inkjet Systems so that we now have digital front end platforms to drive almost any inkjet head within any speed/width requirement. We now have more than 1,000 installations though our OEM partners.”

The market for inkjet will only continue to grow. Speeds and feeds are going to continue to be relevant, as are consumable costs, Farrah believes. Advancements will also come in the form of substrates, post-production handling, color, quality, and consistency.

Thus far, the feedback for Xitron’s product range has been positive, regardless of the technology used. Farrah sees the company only growing in the future.

“Our relevance is rooted in our history,” concludes Farrah. “We’ve been consistently developing RIP and interface technology since the inception of the Harlequin RIP. Our experience during that time has allowed us to bring powerful but economical solutions to all facets of the market, including offset, flexo, digital, screen printing, and high-speed inkjet, with over 36,000 RIPs sold. Based on the number of OEM partners running Xitron software ‘under the hood,’ our expertise is paying off and we’re poised to grow further as printing technologies continue to evolve.”

The new Navigator Flexo Suite isn’t just a RIP and plate ganger, though. It includes SmartFlexo screening, which hits the market at an economical price point.

The Navigator Flexo Suite has seen its biggest improvements in the screening algorithms. “Instead of just offering two or three combinations of resolution, structural dot size, and AM to FM change point, the SmartFlexo screening interface lets each user make adjustments based on their ability to hold dots on plate and print dots on press,” says Bret Farrah, executive vice president of Xitron. “It’s a very customizable approach that helps printers attain maximum quality instead of solutions that work ‘most of the time.”

The Navigator Flexo Suite comes with a low on-board price designed to mesh well with the low cost flexo CTP systems that are now available. Farrah notes, too, that the product will also replace aging and expensive workflows driving existing CDIs.

Traditionally, the investment cost for flexo CTP registered in the neighborhood of $120,000-150,000, for starters. Most new CTP’s come in at the $40,000 range, and Xitron offers its suite for less than $15,000.

“The price/performance ratio has skyrocketed as newer engines have hit the market at very reasonable prices,” notes Farrah. “This means that printers who couldn’t afford in-house platemaking before can now leverage the technology with an attractive ROI.”

Farrah describes the enhanced Navigator Flexo Suite as “unstructured and uncomplicated.” “You can see it when you look at the interface,” he says. “The user can select any resolution, so virtually all CTP engines are covered–even the newer 9600 dpi HD machines. Similarly, there are no restrictions on LPI or where AM changes to FM in highlights and shadows. Just as important, I think, is the flexibility with regard to surface screening (called SmartCells) for better coverage with solids. There are multiple attributes the customer can control, including AM or FM patterns, special shapes, and dot edge protection that are all user-definable and will remove pixels from solid areas for better ink distribution. This is really the first application that puts the user in complete control instead of confining them to a rigid structure and forcing them to conform.”

Just as Xitron partnered with OEM’s, such as Mark Andy, Agfa, and Xeikon, throughout the years, the company has turned its attention to high-speed inkjet and Digital Front End (DFE) workflows. The company is now working with companies like Memjet, Colordyne, Trojan, and multiple others.

“Without question, these partnerships have given us a quick shot out of the starting blocks,” explains Farrah. “When we started development with Memjet several years ago, we were able to learn, grow and develop in parallel with their printhead advancements. We then applied that knowledge to branch development in conjunction with Meteor and Global Inkjet Systems so that we now have digital front end platforms to drive almost any inkjet head within any speed/width requirement. We now have more than 1,000 installations though our OEM partners.”

The market for inkjet will only continue to grow. Speeds and feeds are going to continue to be relevant, as are consumable costs, Farrah believes. Advancements will also come in the form of substrates, post-production handling, color, quality, and consistency.

Thus far, the feedback for Xitron’s product range has been positive, regardless of the technology used. Farrah sees the company only growing in the future.

“Our relevance is rooted in our history,” concludes Farrah. “We’ve been consistently developing RIP and interface technology since the inception of the Harlequin RIP. Our experience during that time has allowed us to bring powerful but economical solutions to all facets of the market, including offset, flexo, digital, screen printing, and high-speed inkjet, with over 36,000 RIPs sold. Based on the number of OEM partners running Xitron software ‘under the hood,’ our expertise is paying off and we’re poised to grow further as printing technologies continue to evolve.”