03.14.19

The Middle East and Africa together represent a diverse geographical region offering real growth opportunities for technical know-how and business expertise of every kind – and therefore for packaging and labeling in particular. The region is a combination of both technologically-advanced and underdeveloped countries. There are an estimated 60 languages spoken here – and its lack of homogeneity presents both challenges as well as opportunities.

At the heart of the established label market in the region is the United Arab Emirates (UAE), whose growing international market profile initially attracted the interest of strong Indian label converters with ambitions to go global. Today, most of the UAE label industry is owned or controlled by parent companies in India.

The UAE’s label market – currently representing around 50 million square meters annually – continues to be a focus for expansion. More and more printers are entering the market and offering regional services – often across the range of labeling technologies. This is creating intense competition. A high proportion of the UAE’s products, and their labels, are exported to other countries, both within the region as well as abroad.

Glue-applied labels

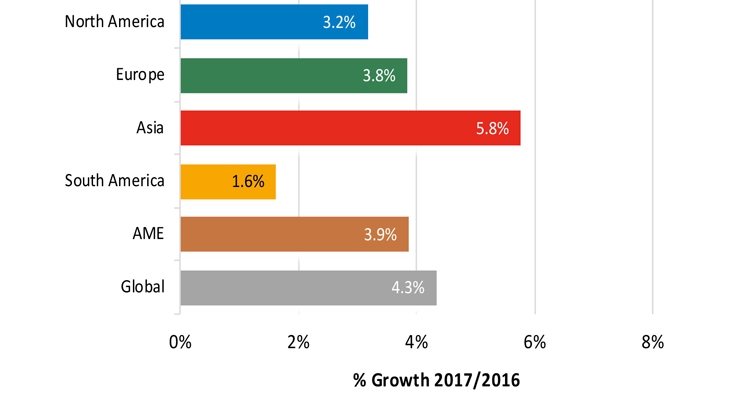

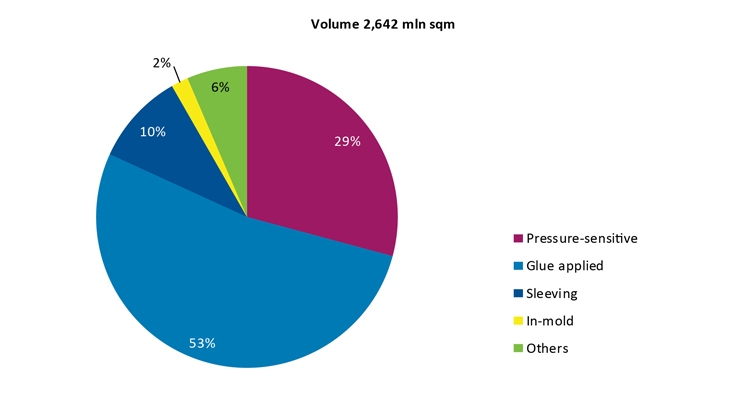

The overall MEA regional label market grew at an estimated 3.9% in 2018. Glue-applied labeling is the main labeling technology, with a 53% market share, and the sector is still growing at a healthy 4% per annum.

Pressure sensitive labels

In the Middle East, as in other parts of the world, pressure sensitive labeling continues to be one of the fastest-growing and predominantly-used labeling formats, with an estimated 40% share of the total label printing market in 2018. Pressure sensitive labels grew at a relatively high rate across the region at 4.1% in 2018. It should be noted that the MEA is, however, still the world’s smallest regional pressure sensitive label market, representing 803 million square meters of volume, which is just 3% of worldwide pressure sensitive label consumption.

In-mold labels

In-mold labels are a format of significant interest in countries around the region, with volumes growing in 2018 by 4.5% to 51 million square meters. Labels for blow molding are the leading application technology, claiming an estimated 71% of Africa and Middle East demand.

Countries such as Israel are already advanced in the use of the technology and in the production of in-mold labels. However, in other countries, such as Egypt, local converting capabilities are limited, and those markets are therefore based on imports from other countries such as Turkey, for example.

In Saudi Arabia and the Gulf States, the established use of IML-EB technologies in the key packaging sectors for locally-sourced oil-based products, industrial and household chemicals is now also expanding into food packaging.

Sleeve labels

Sleeve labeling is another technology of interest in the region, growing overall in 2018 by around 3%. PVC (with a 77% share) represents the leading choice of substrate across MEA – primarily through the dominance of the heat-shrink TD sleeve label format, coupled with the relatively-low cost of imported film grades, and the ease of PVC’s conversion and application. The manufacture of quality polymer films is becoming increasingly strong in the Middle East, as companies seek to move into downstream, value-added products based on the extensive availability of crude oil and natural gas. However, at this time, there are limited sources of quality sleeve label films within the region.

Looking forward

With a forecast growth rate to the end of 2020 of 3.9%, the overall label market in the Middle East and Africa is very much focused on the Middle East, and primarily on the Gulf States and Saudi Arabia.

Ongoing geopolitical and economic issues across much of the region – particularly in Syria and Iraq – are still detracting from the realization of higher penetration rates for packaged and labeled products, but IMF projections still suggest that 3% economic growth regionally can be expected in 2020.

– AWA Alexander Watson Associates

The fastest narrow web press in Lebanon

In the 10 years since its foundation, family-owned and managed Eidco Labels has grown to become one of Lebanon’s leading label suppliers. Housed in a purpose-built facility in Zouk Mikael, on the outskirts of capital city Beirut, the company employs 25 and is self-sufficient from prepress to shipping.

Managing director Eid Zgheib explains the background of his company and its Middle East location. “I’d had 12 years’ experience in pre-press with an international group before starting the business in 2009, so I was familiar with the demands of high-quality print. We are, in fact, the only label supplier in Lebanon to have its own in-house prepress department and believe it is fundamental to our success.”

A close working relationship with the Beirut office of Middle East based Dynagraph Group led Eidco Labels to start off by installing a Mark Andy 2200 press. It proved to be a sharp move, with the company moving into profit after only two months. “The 2200 is a highly productive workhorse. Ours is a 6-color, 10" press with UV and hot air capability, corona and web cleaning, delam/relam, two die stations, a laminator and a sheeter – all of which gives us the capability of producing the wide variety of jobs that were essential to keeping a positive cash flow in the early days,” he adds, saying that the company typically handles 1,100 jobs per year.

The current unrest in the region is posing problems with traditional supply routes, with many land borders with neighboring Syria, Iraq and Jordan closed for freight. So, the company has refocused its product portfolio and markets, and invested in new technology to diversify the business. The latest addition to the plant is one of Mark Andy’s P7 Performance Series all-servo presses. One of the first and the only uprated P7 models installed in the Middle East, it is the only 17" (430mm) narrow web press in Lebanon, and by some measure the fastest, being rated at 300 m/m.

“Despite the ongoing conflict in the region, Lebanese products, especially cosmetics, detergents and food, are well known for their quality and in high demand, and it was to tap into the printed packaging for these markets with shrink sleeves and in-mold labels that we chose the Mark Andy P7,” Zgheib explains. The press has eight UV-flexo print stations and IR drying capability. Fitted with a rail system that supports a screen printhead and cold foil capability, the P7 has a corona treated web cleaner, chambered doctor blades and a single die station.

The P7 press has more than doubled capacity at Eidco Labels, which now has three flexo lines, and is currently responsible for around 90% of local cosmetic labels, 65% of local detergent product labels, and a growing 30% of local food labels. “We first saw the P7 at Labelexpo in Chicago, and within two months we had ordered it, and six months later it was installed. It is the best narrow web press on the market for shrink sleeves and in-mold work because it runs at high speeds without loss of quality – nothing else competes,” he explains.

Speaking for Mark Andy, European ASM Timo Donati, who is responsible for Lebanon, says,“The working relationship between Dynagraph and Eidco Labels has been beneficial to both parties. Like all good partnerships, it’s based on trust and mutual support. Mark Andy is delighted to have such a professional company as its distributor in the region, and I congratulate Eidco Labels on its continued success with our technology.” Both the 2200 and the P7 have been responsible for raising the quality standard of Lebanese labels, according to Eid Zgheib, who does not see any likelihood of investing in digital print technology in the near future.

“I can foresee another two years of conflict in Syria, and even longer, before normality returns to trade in the region, so it’s important that we consolidate our existing capability, as well as search for new opportunities. The P7 is more productive on a wider range of substrates than we could have predicted, so that offers us plenty of scope for expansion.”

Chosen for its ability with unsupported film, the press “can do anything,” according to Eid Zgheib. Run lengths at the plant vary from 1,000 to 50,000 meters, and the press typically runs in-mold jobs at 225 m/m. One thing is for sure, Eidco Labels is well equipped to cope with today’s difficult trading conditions in the region, but also well prepared for a future that hopefully brings peace and restores business links.

Gulf Print & Pack 2019

Registration is now open for Gulf Print & Pack 2019, the Middle East’s leading trade show for the commercial and package printing sector. Returning to the World Trade Center in Dubai, many of the industry’s leading manufacturers and a number of first time exhibitors have already seized the opportunity to exhibit at the show.

Taking place April 15-18 in the venue’s Za’abeel Halls, Gulf Print & Pack 2019 will showcase a comprehensive range of technologies and products from the entire field of commercial and package printing. Confirmed to exhibit at Gulf Print & Pack 2019 are: Afra, Bobst, Frimpeks, Green Graphics, Gulf Commercial Group, Heliozid, Konica Minolta, Prestige Graphics, RotoMetrics, SMI Coated Products, UPM Raflatac and Xerox, as well as first-time exhibitors Apex Industries, Arasta Makina Kimya, Jinhang Flexible Packaging, Lemorau, Meteors, Pule Printing Ltd and Roshan Packages.

Displaying the newest in multi-substrate presses, wide and narrow format digital presses, laser diecutting, 3D printing, smart labels and packaging, and software, Gulf Print & Pack 2019 is aimed at printers, service providers, brand owners and designers from not only the Middle East, but also continental Africa, South Asia and Europe. Buyers can experience live demonstrations of the latest solutions that will help them print a wide range of products for a cross-section of markets including retail, education and security. The show is an ideal setting for visitors to network with the biggest and most influential suppliers operating in today’s market, discover niche markets, and boost their knowledge.

Lisa Milburn, managing director, Gulf Print & Pack, comments, “The Middle East remains one of the world’s key commercial print growth regions, with huge untapped potential for digital technologies. This is reflected in the continuing growth of our show, which plays a vital role in driving the industry forward. At Gulf Print & Pack 2017, we started to see a trend, with half of our visitors interested in digital printing presses; and this year we expect to see this trend explode, given rising demand for short-run digital commercial and package printing, digitally printed labels and smart labels.

“Although its core audience has typically been Middle Eastern and African, we are seeing the show become more international with each edition, so we anticipate an even greater global representation at this year’s show.”

Millburn adds, “This year’s edition of Gulf Print & Pack is especially well timed in the run up to Expo 2020 Dubai, which will create massive opportunities for all type of print, including advertising posters, smart label and packaging products and digital textiles. Given this huge print potential, we expect our show to be a key sourcing event, and we are extremely excited about the opportunities this will create. We look forward to meeting with exhibitors and visitors onsite.”

At the heart of the established label market in the region is the United Arab Emirates (UAE), whose growing international market profile initially attracted the interest of strong Indian label converters with ambitions to go global. Today, most of the UAE label industry is owned or controlled by parent companies in India.

The UAE’s label market – currently representing around 50 million square meters annually – continues to be a focus for expansion. More and more printers are entering the market and offering regional services – often across the range of labeling technologies. This is creating intense competition. A high proportion of the UAE’s products, and their labels, are exported to other countries, both within the region as well as abroad.

Glue-applied labels

The overall MEA regional label market grew at an estimated 3.9% in 2018. Glue-applied labeling is the main labeling technology, with a 53% market share, and the sector is still growing at a healthy 4% per annum.

Pressure sensitive labels

In the Middle East, as in other parts of the world, pressure sensitive labeling continues to be one of the fastest-growing and predominantly-used labeling formats, with an estimated 40% share of the total label printing market in 2018. Pressure sensitive labels grew at a relatively high rate across the region at 4.1% in 2018. It should be noted that the MEA is, however, still the world’s smallest regional pressure sensitive label market, representing 803 million square meters of volume, which is just 3% of worldwide pressure sensitive label consumption.

In-mold labels

In-mold labels are a format of significant interest in countries around the region, with volumes growing in 2018 by 4.5% to 51 million square meters. Labels for blow molding are the leading application technology, claiming an estimated 71% of Africa and Middle East demand.

Countries such as Israel are already advanced in the use of the technology and in the production of in-mold labels. However, in other countries, such as Egypt, local converting capabilities are limited, and those markets are therefore based on imports from other countries such as Turkey, for example.

In Saudi Arabia and the Gulf States, the established use of IML-EB technologies in the key packaging sectors for locally-sourced oil-based products, industrial and household chemicals is now also expanding into food packaging.

Sleeve labels

Sleeve labeling is another technology of interest in the region, growing overall in 2018 by around 3%. PVC (with a 77% share) represents the leading choice of substrate across MEA – primarily through the dominance of the heat-shrink TD sleeve label format, coupled with the relatively-low cost of imported film grades, and the ease of PVC’s conversion and application. The manufacture of quality polymer films is becoming increasingly strong in the Middle East, as companies seek to move into downstream, value-added products based on the extensive availability of crude oil and natural gas. However, at this time, there are limited sources of quality sleeve label films within the region.

Looking forward

With a forecast growth rate to the end of 2020 of 3.9%, the overall label market in the Middle East and Africa is very much focused on the Middle East, and primarily on the Gulf States and Saudi Arabia.

Ongoing geopolitical and economic issues across much of the region – particularly in Syria and Iraq – are still detracting from the realization of higher penetration rates for packaged and labeled products, but IMF projections still suggest that 3% economic growth regionally can be expected in 2020.

– AWA Alexander Watson Associates

The fastest narrow web press in Lebanon

In the 10 years since its foundation, family-owned and managed Eidco Labels has grown to become one of Lebanon’s leading label suppliers. Housed in a purpose-built facility in Zouk Mikael, on the outskirts of capital city Beirut, the company employs 25 and is self-sufficient from prepress to shipping.

Managing director Eid Zgheib explains the background of his company and its Middle East location. “I’d had 12 years’ experience in pre-press with an international group before starting the business in 2009, so I was familiar with the demands of high-quality print. We are, in fact, the only label supplier in Lebanon to have its own in-house prepress department and believe it is fundamental to our success.”

A close working relationship with the Beirut office of Middle East based Dynagraph Group led Eidco Labels to start off by installing a Mark Andy 2200 press. It proved to be a sharp move, with the company moving into profit after only two months. “The 2200 is a highly productive workhorse. Ours is a 6-color, 10" press with UV and hot air capability, corona and web cleaning, delam/relam, two die stations, a laminator and a sheeter – all of which gives us the capability of producing the wide variety of jobs that were essential to keeping a positive cash flow in the early days,” he adds, saying that the company typically handles 1,100 jobs per year.

The current unrest in the region is posing problems with traditional supply routes, with many land borders with neighboring Syria, Iraq and Jordan closed for freight. So, the company has refocused its product portfolio and markets, and invested in new technology to diversify the business. The latest addition to the plant is one of Mark Andy’s P7 Performance Series all-servo presses. One of the first and the only uprated P7 models installed in the Middle East, it is the only 17" (430mm) narrow web press in Lebanon, and by some measure the fastest, being rated at 300 m/m.

“Despite the ongoing conflict in the region, Lebanese products, especially cosmetics, detergents and food, are well known for their quality and in high demand, and it was to tap into the printed packaging for these markets with shrink sleeves and in-mold labels that we chose the Mark Andy P7,” Zgheib explains. The press has eight UV-flexo print stations and IR drying capability. Fitted with a rail system that supports a screen printhead and cold foil capability, the P7 has a corona treated web cleaner, chambered doctor blades and a single die station.

The P7 press has more than doubled capacity at Eidco Labels, which now has three flexo lines, and is currently responsible for around 90% of local cosmetic labels, 65% of local detergent product labels, and a growing 30% of local food labels. “We first saw the P7 at Labelexpo in Chicago, and within two months we had ordered it, and six months later it was installed. It is the best narrow web press on the market for shrink sleeves and in-mold work because it runs at high speeds without loss of quality – nothing else competes,” he explains.

Speaking for Mark Andy, European ASM Timo Donati, who is responsible for Lebanon, says,“The working relationship between Dynagraph and Eidco Labels has been beneficial to both parties. Like all good partnerships, it’s based on trust and mutual support. Mark Andy is delighted to have such a professional company as its distributor in the region, and I congratulate Eidco Labels on its continued success with our technology.” Both the 2200 and the P7 have been responsible for raising the quality standard of Lebanese labels, according to Eid Zgheib, who does not see any likelihood of investing in digital print technology in the near future.

“I can foresee another two years of conflict in Syria, and even longer, before normality returns to trade in the region, so it’s important that we consolidate our existing capability, as well as search for new opportunities. The P7 is more productive on a wider range of substrates than we could have predicted, so that offers us plenty of scope for expansion.”

Chosen for its ability with unsupported film, the press “can do anything,” according to Eid Zgheib. Run lengths at the plant vary from 1,000 to 50,000 meters, and the press typically runs in-mold jobs at 225 m/m. One thing is for sure, Eidco Labels is well equipped to cope with today’s difficult trading conditions in the region, but also well prepared for a future that hopefully brings peace and restores business links.

Gulf Print & Pack 2019

Registration is now open for Gulf Print & Pack 2019, the Middle East’s leading trade show for the commercial and package printing sector. Returning to the World Trade Center in Dubai, many of the industry’s leading manufacturers and a number of first time exhibitors have already seized the opportunity to exhibit at the show.

Taking place April 15-18 in the venue’s Za’abeel Halls, Gulf Print & Pack 2019 will showcase a comprehensive range of technologies and products from the entire field of commercial and package printing. Confirmed to exhibit at Gulf Print & Pack 2019 are: Afra, Bobst, Frimpeks, Green Graphics, Gulf Commercial Group, Heliozid, Konica Minolta, Prestige Graphics, RotoMetrics, SMI Coated Products, UPM Raflatac and Xerox, as well as first-time exhibitors Apex Industries, Arasta Makina Kimya, Jinhang Flexible Packaging, Lemorau, Meteors, Pule Printing Ltd and Roshan Packages.

Displaying the newest in multi-substrate presses, wide and narrow format digital presses, laser diecutting, 3D printing, smart labels and packaging, and software, Gulf Print & Pack 2019 is aimed at printers, service providers, brand owners and designers from not only the Middle East, but also continental Africa, South Asia and Europe. Buyers can experience live demonstrations of the latest solutions that will help them print a wide range of products for a cross-section of markets including retail, education and security. The show is an ideal setting for visitors to network with the biggest and most influential suppliers operating in today’s market, discover niche markets, and boost their knowledge.

Lisa Milburn, managing director, Gulf Print & Pack, comments, “The Middle East remains one of the world’s key commercial print growth regions, with huge untapped potential for digital technologies. This is reflected in the continuing growth of our show, which plays a vital role in driving the industry forward. At Gulf Print & Pack 2017, we started to see a trend, with half of our visitors interested in digital printing presses; and this year we expect to see this trend explode, given rising demand for short-run digital commercial and package printing, digitally printed labels and smart labels.

“Although its core audience has typically been Middle Eastern and African, we are seeing the show become more international with each edition, so we anticipate an even greater global representation at this year’s show.”

Millburn adds, “This year’s edition of Gulf Print & Pack is especially well timed in the run up to Expo 2020 Dubai, which will create massive opportunities for all type of print, including advertising posters, smart label and packaging products and digital textiles. Given this huge print potential, we expect our show to be a key sourcing event, and we are extremely excited about the opportunities this will create. We look forward to meeting with exhibitors and visitors onsite.”