John Penhallow11.15.19

Every other press release you read today seems to announce a quantum leap, which usually turns out to be nothing more exciting than a slightly improved widget. Just occasionally, however, the label world experiences a change so radical it would have made even Einstein sit up and take notice. The advent of digital printing certainly falls into this category. And linerless PS labels could just possibly be the next one. Come off it, you will say, linerless has been around for decades and never made much of an impact. True, but today the wind is turning, and there are straws in it. Many of those straws come from heightened environmental awareness. In particular, an awareness of the problem of what to do with used liner.

Waste not, want not

The problem is serious: in Europe alone, nearly 400,000 tons of liner, plus some 25,000 tons of matrix waste, finish up in waste bins, and from there much of it still goes to landfill. Yes, of course liner can be and is being recycled, but despite much goodwill and hard work from a small band of enthusiasts, progress is going ahead at a snail’s pace. Collection of used liner is expensive and few brand owners are willing to pay good money to fund it; other industry players are even less keen. This should mean the time is ripe for a breakthrough in linerless PS labels. The issue has been the subject of intense discussions again this year, and in particular during the conference “Linerless Labeling” organized by consultants AWA, the day before the opening of Labelexpo Europe. The Italian labelstock producer Ritrama has been developing linerless label systems for bottles and other cylindrical products for several years. This year, Ritrama presented a “Competence Quartet” comprising its own experts, in partnership with press manufacturer Omet, Spilker (finishing equipment) and Ilti (labeling systems). Speaking at the AWA conference, Sergio Veneziani from Ritrama pointed out that to be accepted by brand owners, the linerless label must offer an A to Z solution.

In the Ritrama process, preprinted filmic face material is coated with an acrylic adhesive and fixed to a siliconized transparent PET liner, using specially modified converting equipment from Omet. So far, so standard. But the underside of the liner is coated with a heat-activated adhesive. A converting unit developed by Spilker provides a special cross-web micro-perforation. Then the Ilti labeling unit delaminates the siliconized liner, turns it upside down, heats it and laminates it onto the facestock, where it serves as a protective film to prevent abrasion. The exposed, adhesive-coated facestock is then ready to be applied at high speed to any bottle or other cylindrical product. The patented micro-perforation then separates each label as it is applied. According to Ritrama, the thickness of the entire label, including the laminated liner, can be reduced to as low as 42 microns. By re-using the liner to protect the face material Ritrama’s process eliminates at a stroke the problem of matrix waste and used liner recycling; labels can only be rectangular, which could be a drawback, but as Ritrama’s Veneziani points out, with clear-on-clear labels the end consumer can’t see whether the label is rectangular or not.

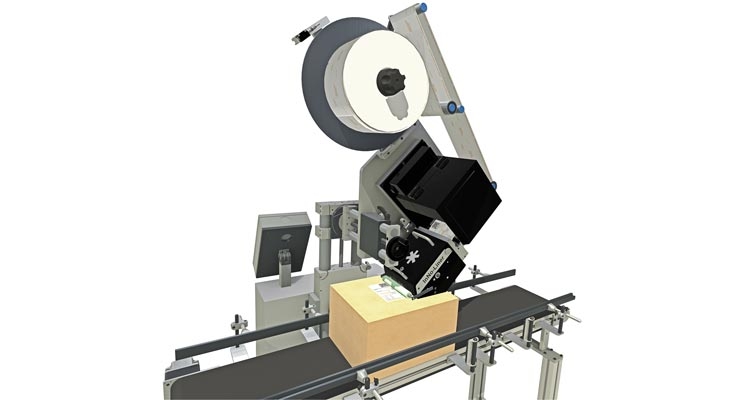

The German labelstock producer Herma has been working on a completely different solution. Herma has not gone for bottle labeling but instead focuses on shipping labels – and according to its own estimates this will amount to 100 billion labels in 2020! Linerless labeling systems, which have been around for decades, are usually heat-activated. However, according to Herma, this significantly reduces application speeds. In Herma’s Inno-Liner system, the “activation,” if one can call it that, is done simply… with water. Markus Gablowski, director of Herma’s Special Coatings Unit, speaking at the AWA conference, listed the benefits: “These labels contain no silicone and can be printed in color. The converter or their customer can choose from a wide variety of media. But most importantly, the liner recycling headache is totally eliminated because there isn’t any.”

These are just two of the innovations shown at the AWA conference and subsequently at Labelexpo Europe. Other companies developing new ideas in linerless include UPM Raflatac, Catchpoint, Maan Group, and ETI Converting. Many of them have repeated the mantra that linerless solutions should be presented not as cheaper but as more environmentally friendly. Only a cynic could think that they are just preaching to the converter.

Labelstock and the green revolution

Even as the linerless label looms, research continues on how to make the good old PS label more environmentally friendly. Avery Dennison, a global labelstock producer, is launching newer and greener products almost every week. Avery’s rPE (Recycled Polyethylene) is already available, and soon rPP and rDT will be added. Liner material is also available from partly (30%) recycled waste materials. Pascale Wautelet, Avery’s vice president of R&D/labels and graphics, says that the limiting factor is not so much chemical but more in the human domain. “The so-called circular economy for both papers and plastics leaves much to be desired,” she maintains. “Even in environmentally conscious Germany, not to mention other continents. Chemical recycling is better than mechanical methods, but in all cases we as labelstock producers need a high quality raw material – and under today’s recycling systems we can get neither the quality nor the quantity we need.”

Several labelstock producers today offer face materials with a high proportion of recycled materials. However, the impurities are visible in the form of tiny gray dots. “This means the end users can see they are contributing to the protection of the environment,” one marketing manager of a labelstock producer told your correspondent. Some would call this making a virtue of necessity. And none of the leading producers has so far gone public on the quantities of recycled materials they are selling.

Brussels brings business

Almost every exhibitor and visitor whom your correspondent met at Labelexpo Europe agreed that the show was a big success, and bigger than in 2017. Since so many print-related shows are struggling, this raises the question: how does Tarsus, the show’s organizer, do it? Not having any major competitor helps of course, as does their decision to move further into printed packaging. Having plenty of innovating exhibitors is at the heart of the show’s success, but so also – credit where credit is due – is the Tarsus organizing team, backed up by focused promotion and advertising. At this year’s show, as usual, the major equipment manufacturers all tried to outdo each other in announcing the number of machines sold during the show: Lombardi rounded up five in the first two days, then MPS announced 12 presses sold, and Mark Andy weighed in with “20 meaningful purchase orders” signed during the event. Can the phenomenal success of this show, now in its 40th year, continue? There is reason to doubt: labels and packaging are allied to economic growth – if more products are being made, more labels and packaging are needed, and vice versa. The latest figures show euro area growth for 2019 at just 1.2%, the same dreary figure as for Britain. Last year’s major label growth markets like Russia and Turkey are down in the doldrums. FINAT’s statistics for 2018 showed PS label growth at between 1-2%, the lowest since the financial crisis of 2007-08. In France, the PS label market actually declined by 1%. It can be argued that the US-China trade war won’t go on forever, nor will the Brexit tragi-comedy. Without being a Cassandra, for which your correspondent does not have the right temperament (or the right sex), a reasonable person may ask whether over the coming few years all those shiny new presses sold at Labelexpo will have enough business to keep them turning.

News from the ink front

All the world’s major ink manufacturers exhibited at Labelexpo. Economic clouds did not dull their colors, and the big news items were about UV LED inks, improved inks for inkjet, and of course, low-migration. Label ink growth is not just in the digital printing sector, according to Benoit Chatelard, the recently appointed managing director of the Flint Group Digital Solutions Division. “Statistics show that flexographic printing is also growing well,” he insists. “And so far only 15% of the total label ink market is going to digitally printed labels. The segmentation into several technologies – toner, inkjet, laser – also increases the growth opportunities for ink manufacturers. Each technology poses a different challenge and that keeps ink manufacturers on their toes.” The situation is not much different for (relatively) smaller ink manufacturers such as Germany’s GSB Wahl. Company owner Jochen Wahl, interviewed on his booth at Labelexpo, also predicted that flexo UV technology will have a rosy future. “Our main business is in flexo UV inks,” he explained. “While special LED inks are on the rise, they are not yet profitable for most purposes – and we’re not interested in digital inks right now because we believe companies like ours can’t make any money with them.” GSB Wahl has decided to invest in the more recherché specialty of waterless offset inks. In cooperation with French press manufacturer Codimag and a handful of other press manufacturers, GSB Wahl has developed, and launched at Labelexpo Europe, a new low migration UV ink series for waterless offset printing. According to Wahl, these new inks have been successfully used on Codimag’s new Aniflo 420. This was confirmed by Codimag CEO Benoît Demol, who added that at Labelexpo demos, printing speeds hit 240 fpm (80 m/m).

It’s a small world

Labelexpo exhibitions in China and India, now well established, helped to bring many modern technologies to Asia-Pacific label markets. Now the boot is well and truly on the other foot. This year in Brussels, Germany still took the gold with 120 exhibitors, but not far ahead of China with 90 and India with 25. The United States fielded 60 and Britain, despite Brexit anxiety, nearly 80 exhibitors. The surprise was Japan, which despite its strong presence in digital label technology, had only 10. Among the 38,000 visitors, those from the Asia-Pacific countries were also much in evidence, and not only because they tend to go round in groups. All of which leads us to conclude that despite economic storm warnings, the label world could be getting brighter – and smaller.

Waste not, want not

The problem is serious: in Europe alone, nearly 400,000 tons of liner, plus some 25,000 tons of matrix waste, finish up in waste bins, and from there much of it still goes to landfill. Yes, of course liner can be and is being recycled, but despite much goodwill and hard work from a small band of enthusiasts, progress is going ahead at a snail’s pace. Collection of used liner is expensive and few brand owners are willing to pay good money to fund it; other industry players are even less keen. This should mean the time is ripe for a breakthrough in linerless PS labels. The issue has been the subject of intense discussions again this year, and in particular during the conference “Linerless Labeling” organized by consultants AWA, the day before the opening of Labelexpo Europe. The Italian labelstock producer Ritrama has been developing linerless label systems for bottles and other cylindrical products for several years. This year, Ritrama presented a “Competence Quartet” comprising its own experts, in partnership with press manufacturer Omet, Spilker (finishing equipment) and Ilti (labeling systems). Speaking at the AWA conference, Sergio Veneziani from Ritrama pointed out that to be accepted by brand owners, the linerless label must offer an A to Z solution.

In the Ritrama process, preprinted filmic face material is coated with an acrylic adhesive and fixed to a siliconized transparent PET liner, using specially modified converting equipment from Omet. So far, so standard. But the underside of the liner is coated with a heat-activated adhesive. A converting unit developed by Spilker provides a special cross-web micro-perforation. Then the Ilti labeling unit delaminates the siliconized liner, turns it upside down, heats it and laminates it onto the facestock, where it serves as a protective film to prevent abrasion. The exposed, adhesive-coated facestock is then ready to be applied at high speed to any bottle or other cylindrical product. The patented micro-perforation then separates each label as it is applied. According to Ritrama, the thickness of the entire label, including the laminated liner, can be reduced to as low as 42 microns. By re-using the liner to protect the face material Ritrama’s process eliminates at a stroke the problem of matrix waste and used liner recycling; labels can only be rectangular, which could be a drawback, but as Ritrama’s Veneziani points out, with clear-on-clear labels the end consumer can’t see whether the label is rectangular or not.

The German labelstock producer Herma has been working on a completely different solution. Herma has not gone for bottle labeling but instead focuses on shipping labels – and according to its own estimates this will amount to 100 billion labels in 2020! Linerless labeling systems, which have been around for decades, are usually heat-activated. However, according to Herma, this significantly reduces application speeds. In Herma’s Inno-Liner system, the “activation,” if one can call it that, is done simply… with water. Markus Gablowski, director of Herma’s Special Coatings Unit, speaking at the AWA conference, listed the benefits: “These labels contain no silicone and can be printed in color. The converter or their customer can choose from a wide variety of media. But most importantly, the liner recycling headache is totally eliminated because there isn’t any.”

These are just two of the innovations shown at the AWA conference and subsequently at Labelexpo Europe. Other companies developing new ideas in linerless include UPM Raflatac, Catchpoint, Maan Group, and ETI Converting. Many of them have repeated the mantra that linerless solutions should be presented not as cheaper but as more environmentally friendly. Only a cynic could think that they are just preaching to the converter.

Labelstock and the green revolution

Even as the linerless label looms, research continues on how to make the good old PS label more environmentally friendly. Avery Dennison, a global labelstock producer, is launching newer and greener products almost every week. Avery’s rPE (Recycled Polyethylene) is already available, and soon rPP and rDT will be added. Liner material is also available from partly (30%) recycled waste materials. Pascale Wautelet, Avery’s vice president of R&D/labels and graphics, says that the limiting factor is not so much chemical but more in the human domain. “The so-called circular economy for both papers and plastics leaves much to be desired,” she maintains. “Even in environmentally conscious Germany, not to mention other continents. Chemical recycling is better than mechanical methods, but in all cases we as labelstock producers need a high quality raw material – and under today’s recycling systems we can get neither the quality nor the quantity we need.”

Several labelstock producers today offer face materials with a high proportion of recycled materials. However, the impurities are visible in the form of tiny gray dots. “This means the end users can see they are contributing to the protection of the environment,” one marketing manager of a labelstock producer told your correspondent. Some would call this making a virtue of necessity. And none of the leading producers has so far gone public on the quantities of recycled materials they are selling.

Brussels brings business

Almost every exhibitor and visitor whom your correspondent met at Labelexpo Europe agreed that the show was a big success, and bigger than in 2017. Since so many print-related shows are struggling, this raises the question: how does Tarsus, the show’s organizer, do it? Not having any major competitor helps of course, as does their decision to move further into printed packaging. Having plenty of innovating exhibitors is at the heart of the show’s success, but so also – credit where credit is due – is the Tarsus organizing team, backed up by focused promotion and advertising. At this year’s show, as usual, the major equipment manufacturers all tried to outdo each other in announcing the number of machines sold during the show: Lombardi rounded up five in the first two days, then MPS announced 12 presses sold, and Mark Andy weighed in with “20 meaningful purchase orders” signed during the event. Can the phenomenal success of this show, now in its 40th year, continue? There is reason to doubt: labels and packaging are allied to economic growth – if more products are being made, more labels and packaging are needed, and vice versa. The latest figures show euro area growth for 2019 at just 1.2%, the same dreary figure as for Britain. Last year’s major label growth markets like Russia and Turkey are down in the doldrums. FINAT’s statistics for 2018 showed PS label growth at between 1-2%, the lowest since the financial crisis of 2007-08. In France, the PS label market actually declined by 1%. It can be argued that the US-China trade war won’t go on forever, nor will the Brexit tragi-comedy. Without being a Cassandra, for which your correspondent does not have the right temperament (or the right sex), a reasonable person may ask whether over the coming few years all those shiny new presses sold at Labelexpo will have enough business to keep them turning.

News from the ink front

All the world’s major ink manufacturers exhibited at Labelexpo. Economic clouds did not dull their colors, and the big news items were about UV LED inks, improved inks for inkjet, and of course, low-migration. Label ink growth is not just in the digital printing sector, according to Benoit Chatelard, the recently appointed managing director of the Flint Group Digital Solutions Division. “Statistics show that flexographic printing is also growing well,” he insists. “And so far only 15% of the total label ink market is going to digitally printed labels. The segmentation into several technologies – toner, inkjet, laser – also increases the growth opportunities for ink manufacturers. Each technology poses a different challenge and that keeps ink manufacturers on their toes.” The situation is not much different for (relatively) smaller ink manufacturers such as Germany’s GSB Wahl. Company owner Jochen Wahl, interviewed on his booth at Labelexpo, also predicted that flexo UV technology will have a rosy future. “Our main business is in flexo UV inks,” he explained. “While special LED inks are on the rise, they are not yet profitable for most purposes – and we’re not interested in digital inks right now because we believe companies like ours can’t make any money with them.” GSB Wahl has decided to invest in the more recherché specialty of waterless offset inks. In cooperation with French press manufacturer Codimag and a handful of other press manufacturers, GSB Wahl has developed, and launched at Labelexpo Europe, a new low migration UV ink series for waterless offset printing. According to Wahl, these new inks have been successfully used on Codimag’s new Aniflo 420. This was confirmed by Codimag CEO Benoît Demol, who added that at Labelexpo demos, printing speeds hit 240 fpm (80 m/m).

It’s a small world

Labelexpo exhibitions in China and India, now well established, helped to bring many modern technologies to Asia-Pacific label markets. Now the boot is well and truly on the other foot. This year in Brussels, Germany still took the gold with 120 exhibitors, but not far ahead of China with 90 and India with 25. The United States fielded 60 and Britain, despite Brexit anxiety, nearly 80 exhibitors. The surprise was Japan, which despite its strong presence in digital label technology, had only 10. Among the 38,000 visitors, those from the Asia-Pacific countries were also much in evidence, and not only because they tend to go round in groups. All of which leads us to conclude that despite economic storm warnings, the label world could be getting brighter – and smaller.