07.25.18

Bobst Group has recorded very good first half-year sales of CHF 762.5 million for the first six months of 2018, compared to CHF 643.2 million in the first half of 2017. The operating result (EBIT) decreased by CHF 4.6 million to CHF 35.2 million. The net result reached CHF 24.9 million, down from CHF 27.7 million in the previous year. Order entries increased by 13% and the order backlog is 14% higher than in the previous year. The Group has lowered its 2018 full year profit guidance and expects to achieve an operating result (EBIT) of higher than CHF 90 million for the full year 2018 (compared to slightly higher than CHF 119 million in 2017).

During the first half of 2018, consolidated sales amounted to CHF 762.5 million, representing an increase of CHF 119.3 million, or +18.6%, compared with the same period in 2017. This evolution was mainly driven by a high backlog at the beginning of the year and an overall good level of activity in all three Business Units. Volume and price variances had a positive impact of CHF 93.2 million, or +14.5%. An improvement of CHF 0.2 million came from the creation of two new entities in Vietnam and in the Netherlands.

The exchange rates had an overall positive impact on sales of CHF 25.9 million. The evolution due to the conversion of foreign currencies for consolidation accounts for CHF 19.7 million, or +3.1%, and the transactional impact on sales volume from our Swiss operations accounts for CHF 6.2 million, or +1.0%.

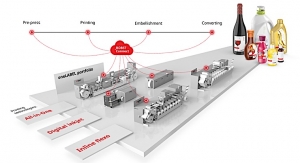

The operating result (EBIT) reached CHF 35.2 million compared with CHF 39.8 million for the same period in 2017. An unfavorable product mix, the ramp-up of the digital printing activities as well as further investments to strengthen the Group's sales and service network, and capabilities in growing markets, more than compensated the positive contribution from higher sales, leading to the reduction of the operating result (EBIT).

Business Unit Sheet-fed increased its operating result (EBIT) by CHF 17.1 million to reach CHF 29.7 million due to the strong increase in sales in the first half of the year and an optimal utilization of the industrial capacities. Business Unit Web-fed continues to have an unfavorable product mix and high pressure on margins. The ramp-up of the new site in China and of the product lines structure, as well as higher than expected restructuring efforts at one of our German entities, had also a negative impact on the Business Unit's profitability. The operating result (EBIT) was CHF -20.2 million in the first half of 2018 compared to CHF -5.3 million in the first six months of 2017. Business Unit Services has significantly increased the number of field service technicians and technical support people, according with the Group's strategy. The induction and training costs have a negative impact on the Business Unit's operating result (EBIT), which was CHF 27.4 million in H1 2018 compared with CHF 33.2 million in the same period in 2017. All three Business Units have higher costs due to the ramp-up of the Group's digital printing activities (Mouvent) which have been part of BOBST since June 1st, 2017.

Net result reached CHF 24.9 million, compared to CHF 27.7 million in 2017. The decrease in net result is mainly due to lower operating result (EBIT) and lower result from associates.

Net cash reduced to CHF 31.8 million from CHF 132.9 million at the end of 2017. This is mainly due to dividends paid and temporarily higher inventories for machines to be invoiced in the second half of the year. The consolidated shareholders' equity reached 35.0% of the total balance sheet, compared to 35.6% at the end of 2017.

Business Unit: Sheet-fed

Total bookings follow a positive trend with an increase of 13% compared to the same period in 2017 and a continuous good performance in the corrugated board industry, with 17% increase; folding carton is at a similar level with good potential for the rest of the year. Mature markets continue to lead the growth, with North America showing better result than last year, with 25% increase. China has improved bookings by more than 35%, due to the new China 4.0 strategy implemented in the first quarter of this year, and expects good results for the months to come, with the last successful Open House held in June at the Shanghai premises.

Thanks to the opportunity to ship machines very early in the year, the first half of 2018 was very strong, with an improvement in sales of 29% versus last year, in both corrugated board and folding carton industries, mainly in the mature markets with North America ahead by more than 50% in comparison with last year. In the emerging markets, only China is doing better than last year, due to the new China 4.0 strategy.

Overall the outlook for the full year is promising, based upon the current backlog and an expected solid second half. There will of course be challenges still to meet, especially for the hot foil stamping products and part of the emerging markets, especially Middle East and Africa.

Business Unit: Web-fed

Business activity in flexible materials remains at a good level with regards to bookings, with an increase of 13% compared to the previous year. There were no significant changes in the market compared to 2017. Mature countries remain in line with the expected volumes. In the emerging countries, except for a slow start in South-East Asia, Africa and Middle East, the remaining countries are at a good level of activity.

Business Unit Web-fed participated in numerous international exhibitions, such as Plast India in Ahmedabad, Plast Print Pack in Karachi, Expo Print in São Paolo, amongst others. The roadshows with partners organized in Europe, Middle East, Asia, Central and South Americas were well attended and welcomed by prospects and customers.

In May, the new China plant and Competence Center in Changzhou was inaugurated. This new infrastructure will allow Business Unit Web-fed to increase its footprint in Asia and to better serve the local market.

First half-year sales increased by 12% compared with the same period in 2017 but with a completely different, and less favorable product mix. The Business Unit expects a very busy second half of the year leading to an even more unbalanced situation than in previous years.

In order to reach an ambitious growth plan until 2020, the overall structure of the product lines was reinforced to support the future growth.

Business Unit: Services

First half-year sales for the Business Unit Services were 7% above the same period in 2017. In the European markets, the business volume increased, mainly through more maintenance programs, machinery inspections and contracts for remote troubleshooting and monitoring.

The emerging markets, such as Middle East and Africa (MENA) and India, recorded the highest growth rates. It reflects the efficiency of the new organization's implementation and the standardization of business processes, which have increased customer satisfaction. While MENA and India grew by more than 25% compared to 2017, North America showed only a slight increase in service business. In Japan and South East Asia, overall service business is stagnating compared to 2017. We expect to see normal business development for the second half of 2018, if no major changes in the world economy or exchange rates occur.

The Business Unit Services will continue to increase in competencies to support the worldwide growth of machine installations and increasing demands of customers. The focus for the remainder of 2018 will therefore be to 'hire, train and retain' service technicians, to further optimize the distribution centers in Asia and in North America, and to continue to further improve customer satisfaction.

Second half outlook

Bobst Group expects to see continued good demand for its products and services, leading to a very active second half of 2018 in nearly all plants. Based on the strong sales growth and a good overall market situation, the Group has accelerated some measures to:

At current exchange rates, and barring unforeseen circumstances, the Group expects to improve its full year 2018 sales by 5-7% compared to 2017, which is at the higher end of the guidance issued at the end of February 2018. The guidance for the full year operating result (EBIT) which was "slightly higher than previous year (CHF 119 million)", has to be reduced due to the aforementioned reasons. The Group expects to achieve an operating result (EBIT) higher than CHF 90 million for the full year 2018.

The mid- to long-term financial targets of at least 8% operating result (EBIT) and a minimum 20% return on capital employed (ROCE) remain unchanged.

During the first half of 2018, consolidated sales amounted to CHF 762.5 million, representing an increase of CHF 119.3 million, or +18.6%, compared with the same period in 2017. This evolution was mainly driven by a high backlog at the beginning of the year and an overall good level of activity in all three Business Units. Volume and price variances had a positive impact of CHF 93.2 million, or +14.5%. An improvement of CHF 0.2 million came from the creation of two new entities in Vietnam and in the Netherlands.

The exchange rates had an overall positive impact on sales of CHF 25.9 million. The evolution due to the conversion of foreign currencies for consolidation accounts for CHF 19.7 million, or +3.1%, and the transactional impact on sales volume from our Swiss operations accounts for CHF 6.2 million, or +1.0%.

The operating result (EBIT) reached CHF 35.2 million compared with CHF 39.8 million for the same period in 2017. An unfavorable product mix, the ramp-up of the digital printing activities as well as further investments to strengthen the Group's sales and service network, and capabilities in growing markets, more than compensated the positive contribution from higher sales, leading to the reduction of the operating result (EBIT).

Business Unit Sheet-fed increased its operating result (EBIT) by CHF 17.1 million to reach CHF 29.7 million due to the strong increase in sales in the first half of the year and an optimal utilization of the industrial capacities. Business Unit Web-fed continues to have an unfavorable product mix and high pressure on margins. The ramp-up of the new site in China and of the product lines structure, as well as higher than expected restructuring efforts at one of our German entities, had also a negative impact on the Business Unit's profitability. The operating result (EBIT) was CHF -20.2 million in the first half of 2018 compared to CHF -5.3 million in the first six months of 2017. Business Unit Services has significantly increased the number of field service technicians and technical support people, according with the Group's strategy. The induction and training costs have a negative impact on the Business Unit's operating result (EBIT), which was CHF 27.4 million in H1 2018 compared with CHF 33.2 million in the same period in 2017. All three Business Units have higher costs due to the ramp-up of the Group's digital printing activities (Mouvent) which have been part of BOBST since June 1st, 2017.

Net result reached CHF 24.9 million, compared to CHF 27.7 million in 2017. The decrease in net result is mainly due to lower operating result (EBIT) and lower result from associates.

Net cash reduced to CHF 31.8 million from CHF 132.9 million at the end of 2017. This is mainly due to dividends paid and temporarily higher inventories for machines to be invoiced in the second half of the year. The consolidated shareholders' equity reached 35.0% of the total balance sheet, compared to 35.6% at the end of 2017.

Business Unit: Sheet-fed

Total bookings follow a positive trend with an increase of 13% compared to the same period in 2017 and a continuous good performance in the corrugated board industry, with 17% increase; folding carton is at a similar level with good potential for the rest of the year. Mature markets continue to lead the growth, with North America showing better result than last year, with 25% increase. China has improved bookings by more than 35%, due to the new China 4.0 strategy implemented in the first quarter of this year, and expects good results for the months to come, with the last successful Open House held in June at the Shanghai premises.

Thanks to the opportunity to ship machines very early in the year, the first half of 2018 was very strong, with an improvement in sales of 29% versus last year, in both corrugated board and folding carton industries, mainly in the mature markets with North America ahead by more than 50% in comparison with last year. In the emerging markets, only China is doing better than last year, due to the new China 4.0 strategy.

Overall the outlook for the full year is promising, based upon the current backlog and an expected solid second half. There will of course be challenges still to meet, especially for the hot foil stamping products and part of the emerging markets, especially Middle East and Africa.

Business Unit: Web-fed

Business activity in flexible materials remains at a good level with regards to bookings, with an increase of 13% compared to the previous year. There were no significant changes in the market compared to 2017. Mature countries remain in line with the expected volumes. In the emerging countries, except for a slow start in South-East Asia, Africa and Middle East, the remaining countries are at a good level of activity.

Business Unit Web-fed participated in numerous international exhibitions, such as Plast India in Ahmedabad, Plast Print Pack in Karachi, Expo Print in São Paolo, amongst others. The roadshows with partners organized in Europe, Middle East, Asia, Central and South Americas were well attended and welcomed by prospects and customers.

In May, the new China plant and Competence Center in Changzhou was inaugurated. This new infrastructure will allow Business Unit Web-fed to increase its footprint in Asia and to better serve the local market.

First half-year sales increased by 12% compared with the same period in 2017 but with a completely different, and less favorable product mix. The Business Unit expects a very busy second half of the year leading to an even more unbalanced situation than in previous years.

In order to reach an ambitious growth plan until 2020, the overall structure of the product lines was reinforced to support the future growth.

Business Unit: Services

First half-year sales for the Business Unit Services were 7% above the same period in 2017. In the European markets, the business volume increased, mainly through more maintenance programs, machinery inspections and contracts for remote troubleshooting and monitoring.

The emerging markets, such as Middle East and Africa (MENA) and India, recorded the highest growth rates. It reflects the efficiency of the new organization's implementation and the standardization of business processes, which have increased customer satisfaction. While MENA and India grew by more than 25% compared to 2017, North America showed only a slight increase in service business. In Japan and South East Asia, overall service business is stagnating compared to 2017. We expect to see normal business development for the second half of 2018, if no major changes in the world economy or exchange rates occur.

The Business Unit Services will continue to increase in competencies to support the worldwide growth of machine installations and increasing demands of customers. The focus for the remainder of 2018 will therefore be to 'hire, train and retain' service technicians, to further optimize the distribution centers in Asia and in North America, and to continue to further improve customer satisfaction.

Second half outlook

Bobst Group expects to see continued good demand for its products and services, leading to a very active second half of 2018 in nearly all plants. Based on the strong sales growth and a good overall market situation, the Group has accelerated some measures to:

- Invest in quality upgrades on some new products launched in recent years;

- Launch a range of digital printing products;

- Strengthen its activities in Internet-of-Things (IoT);

- Increase its sales and service network, and capabilities in growing markets.

At current exchange rates, and barring unforeseen circumstances, the Group expects to improve its full year 2018 sales by 5-7% compared to 2017, which is at the higher end of the guidance issued at the end of February 2018. The guidance for the full year operating result (EBIT) which was "slightly higher than previous year (CHF 119 million)", has to be reduced due to the aforementioned reasons. The Group expects to achieve an operating result (EBIT) higher than CHF 90 million for the full year 2018.

The mid- to long-term financial targets of at least 8% operating result (EBIT) and a minimum 20% return on capital employed (ROCE) remain unchanged.